Posts Tagged ‘level 3 payments’

Level 3 data processing

I’d like to share a few ideas that can help you lower your cost of accepting B2B and B2G transactions by up to 40% regardless of the rate your processor charges you. Submitting level 3 data processing when you process these transactions and save BIG, if you are set up properly. Accept B2B and B2G…

+ Read MoreCredit card processing levels

Credit card processing levels refers to the additional line item details that are included with a credit card transaction. Level 1 processing refers to business-to-consumer (B2C) transactions, during which consumers use a personal credit cards to make purchase. The data required for a Level 1 transaction is minimum including the merchant name, transaction amount and date.…

+ Read MoreLevel III Processing Interchange Rates

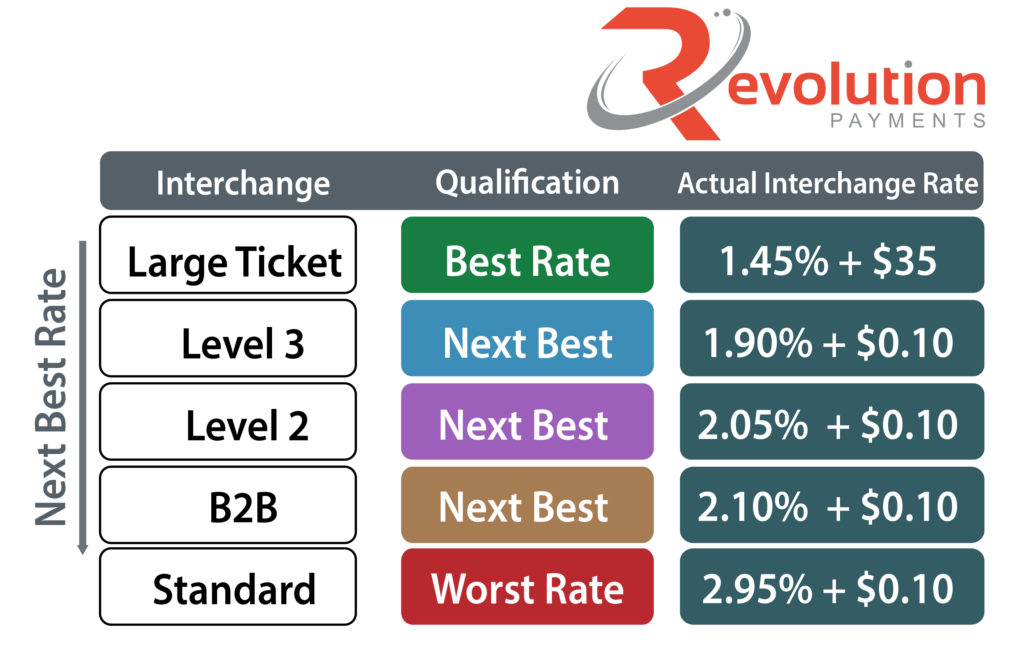

Level III Processing Interchange Rates Exponentially Increase Your Bottom Line Profits on Each Business or Government Credit Card You Accept Without Doing Any Extra Work With level 3 processing interchange rates It’s Easier than you think! At Revolution Payments we’ve developed a unique solution that can increase your profit margins by roughly 1%, on…

+ Read MoreWhy Level 3 Processing | Receive your complimentary review today!

I’m going to share why level 3 processing aka (level 3 line item detail) is so important if you accept credit cards from businesses or government. For most businesses, credit card processing fees are in the top 5 of all expenses. All business people and entrepreneurs are busy, but the time invested in learning the…

+ Read MoreCapture Levels II and III data when accepting commercial cards

Capture Levels II and III data when accepting commercial cards and reduce the interchange cost of accepting B2B transactions. Capturing level II and Level III payment data on B2B and B2G transactions, can lower your overall cost of accepting these cards by 30%-40%. Business, government, fleet, commercial, and purchasing cards are used just like personal…

+ Read MoreHelping Government Contractors & B2B Merchants Reduce Transaction Cost for Accepting Commercial Credit Cards

Government Contractors and Vendors can reduce the cost of accepting Government and Commercial credit cards by as much as 40% with Revolution Payments value enhancing payment technology Revolution Payments, the leader when it comes to Level-3 payments. Our specialized payment solutions are helping Government Contractors and Vendors Reduce the cost of accepting government and commercial credit…

+ Read MoreSimplified Level 3 credit card processing solutions!

Revolution Payment Systems simplifies setting up and processing level 3 line item detail. Level 3 credit card processing can be a great money saving addition for businesses that accept commercial, purchase and government credit cards. Our Level automated level 3 payment solutions allow these merchants to qualify for the reduced level 3 processing interchange rates.…

+ Read MoreWhat is Level 3 Payment Processing?

What is Level 3 Payment Processing? This short video explains. Level 3 payment processing is the best solution if your accepting credit cards from large corporations or government. This short video explains how level 3 processing can lower your interchange costs on B2B & B2G credit card transactions by 1%-1.5%. Savings is further increased for…

+ Read MoreReduce your monthly processing Fees with a B2B & B2G Merchant Account

A B2B & B2G Merchant Account Can Lower The Cost of Accepting Commercial Cards by 40% Level 3 Interchange Rates 1.75% MasterCard 1.85% Visa .40%-1.58% transactions over $5800 Commercial Cards Commercial, business, purchasing, corporate & government cards processed without level-2 and or level-3 qualify at different interchange codes between .50%-1.5% higher. The Bulk of the…

+ Read MoreLevel 3 Merchant Processing

passing level 3 detail can reduce your transaction cost for accepting commercial transactions.

+ Read More