TRUSTED BY THESE COMPANIES

We're changing the way you think

about credit card processing

At Revolution Payments, we do things differently, and have for over 20 years. Our clients are some of the most educated consumers around.

Why? Because we take the time to give them straight answers about everything they need to know — how to read and understand their statements, knowledge about their fees, the latest technology, and impeccable personalized customer service — all while helping them run their business more efficiently without any long-term contracts.

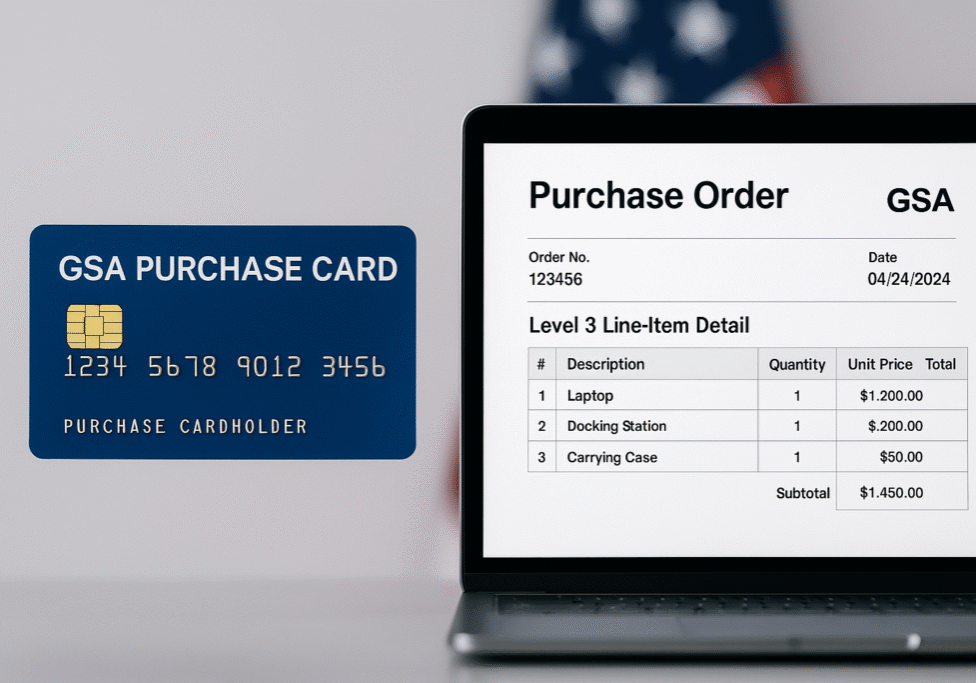

We are nationally recognized Level 3 processing experts in the B2B payments space, helping companies reduce their interchange costs by up to 40%.

How Our Beliefs Benefit You

At Revolution Payments, we are committed to principles of social responsibility, fair pricing, honest practices, and always doing the right thing. No exceptions

Advocating for Your Success

Business isn’t just about the bottom line — happy merchants create a positive workplace. By fostering a culture of commerce with compassion, we benefit our community of customers, partners, and employees.

We advocate for your rights to ensure fair and transparent payment processing

No secrets, surprises, or deception. Transparency is our mantra. We demystify the world of payment processing and Interchange Pricing with clear examples and education. Our prices are fully disclosed and highly competitive.