Level 3 processing

Understanding Level I, Level II, and Level III Credit Card Processing

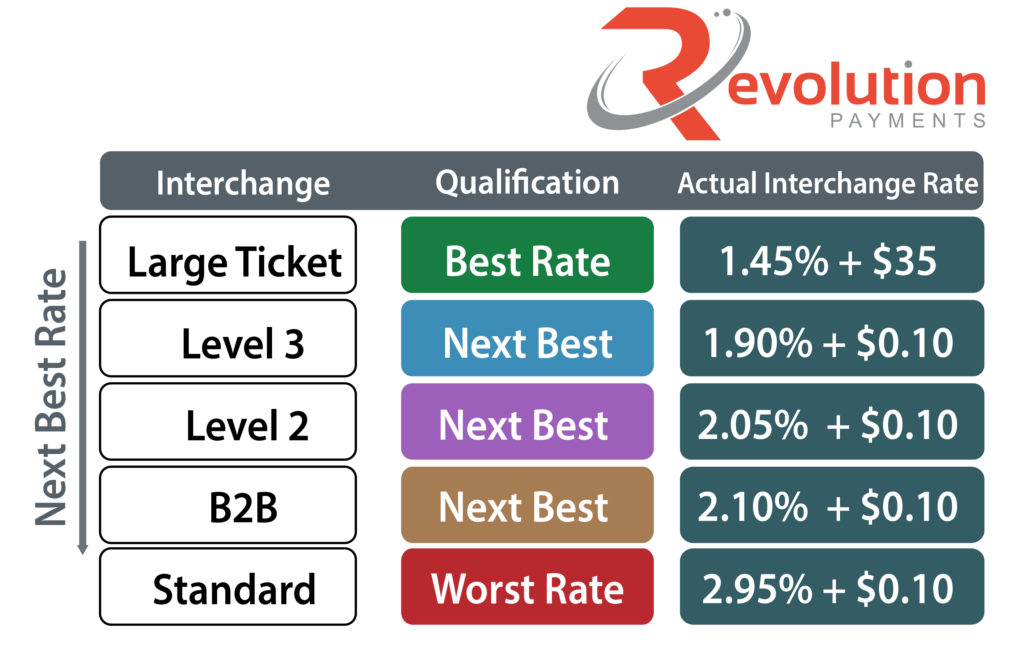

Understanding Level I, Level II, and Level III Credit Card Processing along with the rates and fees that impact your bottom line can have a huge impact on bottom line revenues. I, Level II, and Level III credit card processing delineate the different interchange categories and qualifications for business-to-business (B2B) and business-to-government (B2G) credit card…

+ Read MoreLevel 3 credit card processing savings

If your company accepts credit cards from other businesses and or government and your not including level 3 credit card processing data, you are leaving a lot of money on the table, that you cannot get from a processor. The chart below shows the level 3 credit card processing savings and the high ticket interchange…

+ Read MoreLevel 3 data processing

I’d like to share a few ideas that can help you lower your cost of accepting B2B and B2G transactions by up to 40% regardless of the rate your processor charges you. Submitting level 3 data processing when you process these transactions and save BIG, if you are set up properly. Accept B2B and B2G…

+ Read MoreWinning Government Contracts

Winning government contracts and keeping more profits!! Once you win a government contract how can you keep more of your money? One way contractors can offer government clients the best possible price without pinching their margins is by becoming Level-3 credit card processing compliant. With Level-3 contractors can guarantee that they are getting the best…

+ Read MoreCommercial Card Optimization

Automated Commercial Card Optimization Take advantage of Level II and Level III processing to reduce costs. Many businesses are unknowingly leaving money table and don’t even realize it. The fees for accepting credit cards are a big part of doing business however, there are programs that existing to help reduce these interchange fees. There…

+ Read MoreCredit card processing levels

Credit card processing levels refers to the additional line item details that are included with a credit card transaction. Level 1 processing refers to business-to-consumer (B2C) transactions, during which consumers use a personal credit cards to make purchase. The data required for a Level 1 transaction is minimum including the merchant name, transaction amount and date.…

+ Read MoreLevel-3 Data Capable Software Provider

If you accept government purchase cards, it may be worth investigating a level-3 data capable software provider. Visa and MasterCard created special interchange rates to support purchase/commercial card program by reducing the transaction cost (interchange) if Level 3 line item detail is provided with the transaction. By providing Level 3 data, a supplier can reduce…

+ Read MoreLower your processing rates with level-2 and level-3 processing

How you can lower your processing rates with level-2 and level-3 processing You probably already know that whenever you take a credit card you must pay an interchange fee on that card, everybody does. These interchange fees can amount to more than 80% of your total expense and goes back to the bank that issued…

+ Read MoreLevel 3 Payment Processing solution for QuickBooks Online

Revolution Payments reveals a Level 3 Payment Processing solution for QuickBooks Online users. Level 3 processing can reduce the interchange for accepting credit cards from other businesses and or government by up to 43%. Interchange is responsible for the bulk of the fees you pay to accept credit cards; it’s also paid to the card issuing bank.…

+ Read MoreHow to Reduce B2B Credit Card Acceptance Costs

Revolution Payments can show you how to reduce B2B credit card acceptance costs. All to often we work with business owners unaware of the fact that interchange rates can be improved by qualifying commercial and B2B credit card transactions more effectively. The bulk of total fees paid by businesses to accept credit cards are interchange…

+ Read More